Statutory refers to Internal Revenue Service IRS classification of such workers as subject to tax withholding by statute under its common-law rules. Some types of statutory income are commission lump sum payments for.

Taxtips Ca Business 2020 Corporate Income Tax Rates

Employers withhold the employee portion of Social.

. Section 10-5 of ITAA 1997 accessible from the ATO website. 21000 per month If employees. A statutory employee is defined by the law as an employee who works for a business but the employer is not required to withhold taxes from their earnings.

Statutory employee definition A statutory employee is an independent contractor who qualifies for employee treatment. Compensation for services including fees commissions fringe benefits and similar items. Code 61 - Gross income defined.

2 Amounts that are not ordinary income but are included in your assessable income by provisions about assessable income. Statutory accounts also known as annual accounts are a set of financial reports prepared at the end of each financial year. Income from an interest in an estate or trust.

A statutory employee is someone who is not quite a common law employee somebody legally employed by a business or an independent contractor somebody who is self-employed and. An individual who works at home on materials or goods that you supply and that must be returned to you or to a person you name if you also furnish specifications for the work. A statutory employee is an independent contractor who is considered an employee for tax withholding purposes.

A statutory employee is a special type of worker whose wages are not subject to federal income tax withholding but are subject to FICA Social Security and Medicare. Statutory income are amounts outside the ordinary concepts of income that have been specifically included in assessable income. For a standard independent.

This income is earned in the basis period from 1 Jan to 31 Dec 2021 and hence it will be. Annual turnover is the total ordinary income that you derive in the income year in the course of running your. Statutory Bonus is payable within 8 months from the close of the accounting year Payable to all employees whose wages do not exceed Rs.

Statutory Net Income means with respect to any Insurance Subsidiary for any computation period the net income earned by such Person during such period as determined in. An individual who works at home on materials or goods that you supply and that must be returned to you or to a person you name if you also furnish specifications. An employee who is allowed to deduct expenses on Schedule C Business Income or Loss is a statutory employee although he or she still receives a W-2 from an employer.

The highest income tax rate a person or business qualifies for is referred to as their tax bracket. Calculating a statutory employees income. Ordinary income encompasses earnings interest regular dividends rental income distributions from pensions or retirement accounts and Social Security.

The statutory tax rates are the tax rates that are established by the law. In the UK all private limited companies are required to prepare. An individual must meet certain criteria to be.

No Votes Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given. However the employer is. A statutory employee is an independent contractor under American common law who is treated as an employee by statute for purposes of tax withholdings.

Statutory income is listed in s6-10 2 ITAA97. Statutory income is income that is not part of the income from an hourly or salary job. Employment income Mr Tan has employment income from 1 Jan 2021 to 31 Dec 2021.

When we say turnover we mean aggregated turnover.

Severance And Income Tax In Canada Dutton Employment Law

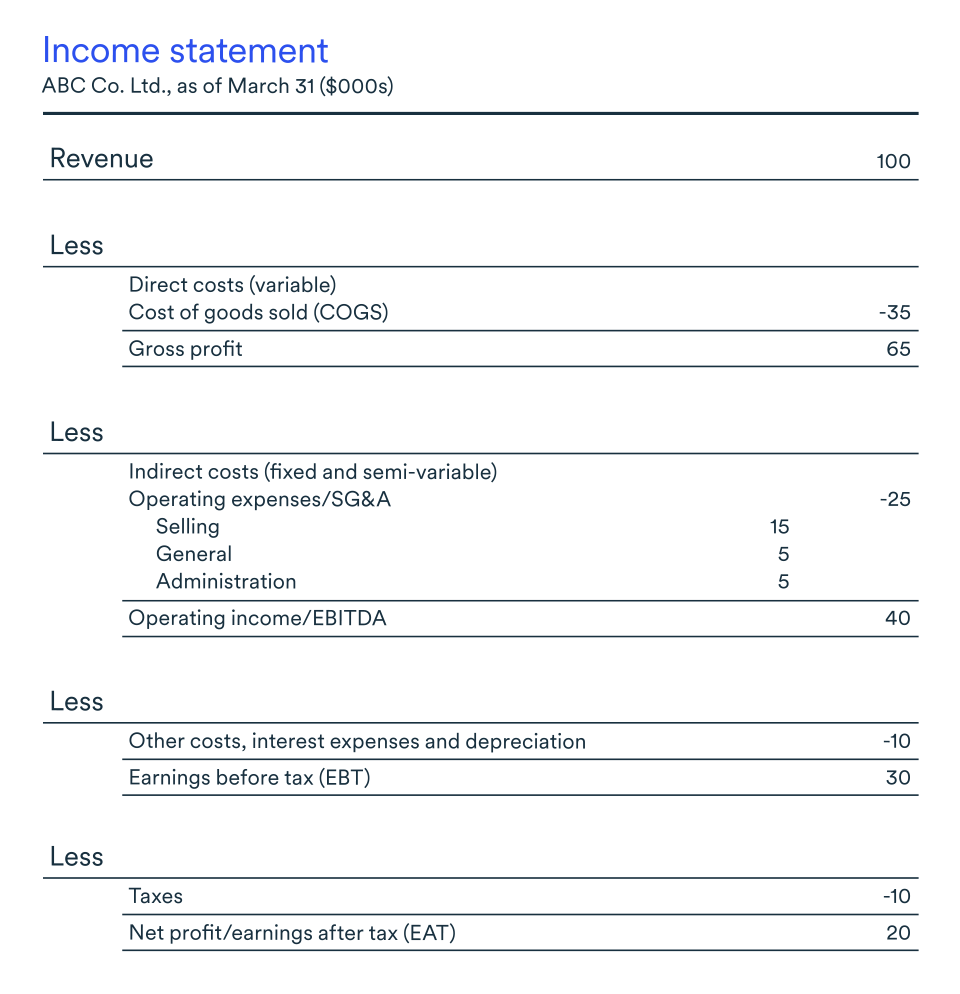

Ebitda Vs Operating Income Top 5 Differences With Infographics

Provision For Income Tax Definition Formula Calculation Examples

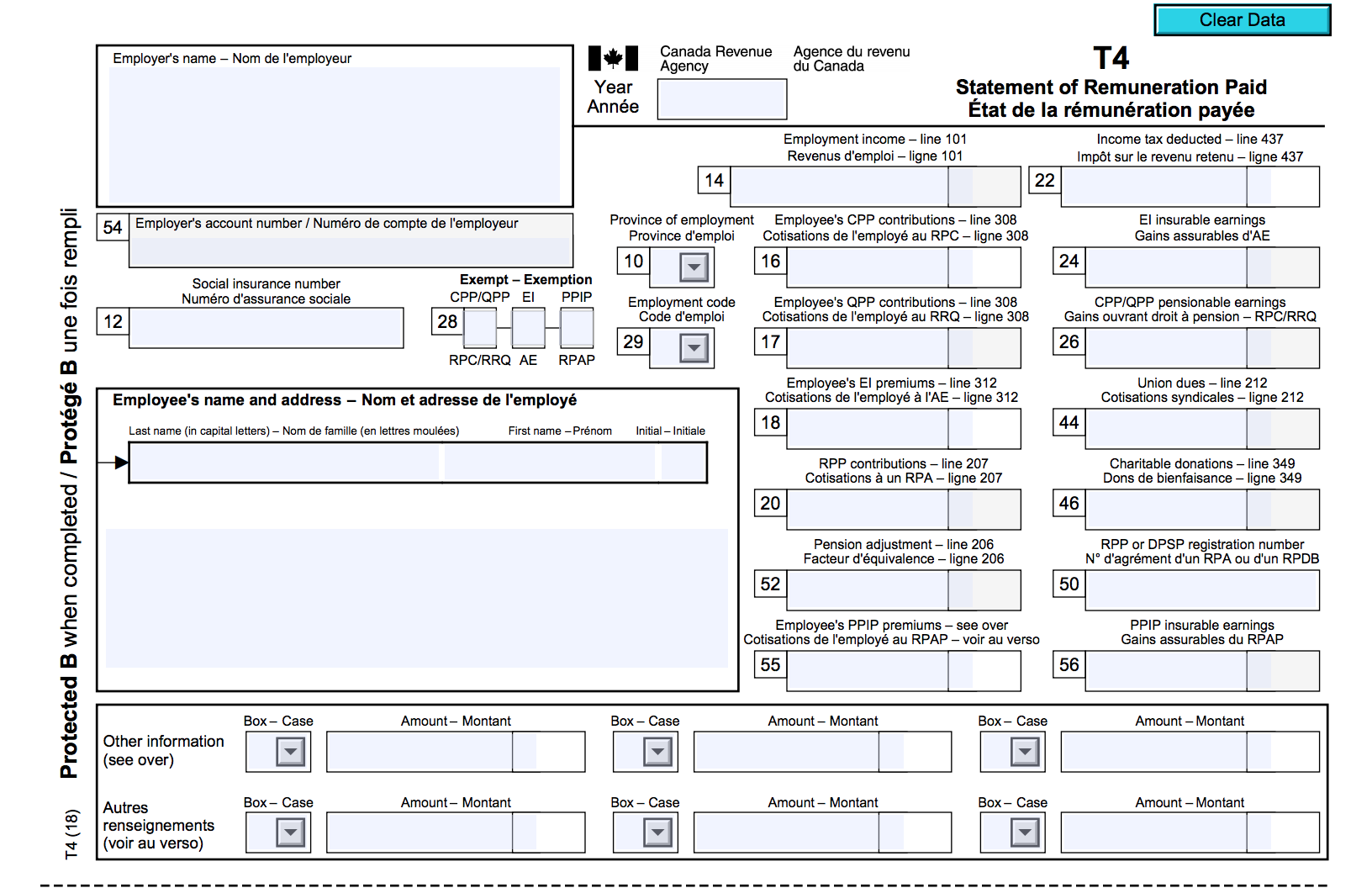

The Canadian Employer S Guide To The T4 Bench Accounting

Statement Of Comprehensive Income Overview Components And Uses

Tax Accounting Meaning Pros Components And More

Prenuptial Agreement Templates Template Business

Pretax Income Definition Formula And Example Significance

Depository Receipts Learn Accounting Accounting Education Accounting And Finance

Taxation Of Virtual Digital Assets As Introduced In Finance Bill 2022 In 2022 Finance Digital Virtual

What Are Operating Expenses Bdc Ca

Provision For Income Tax Definition Formula Calculation Examples

Operating Income Overview Formula Sample Calculation

Ebitda Vs Operating Income Top 5 Differences With Infographics

Differences Between Cost Accounting And Financial Accounting

Rbi Norms For Nbfc Registration In India Registration Business Profile How To Apply